Regardless of your sector or industry, it’s likely that your financial department is the beating heart of your entire operation. Without financial fluency, it’s difficult for an organization to thrive, which means that keeping your monetary affairs in order is essential.

As a business, you need the reliability of frequent financial reports to gain a better grasp of your financial status, both current and future. In addition to empowering you to take a proactive approach concerning the management of your company’s finances, financial reports help assist in increasing long-term profitability through short-term financial statements.

A robust finance report communicates crucial financial information that covers a specified period through daily, weekly, and monthly financial reports. These are powerful tools that you can apply to increase internal business performance. A data-driven finance report is also an effective means of remaining updated with any significant progress or changes in the status of your finances, and help you measure your financial results, cash flow, and financial position.

Here, we will look at these kinds of reports in greater detail, delving into daily and weekly reports, but focusing mainly on monthly financial reports and examples you can use for creating your own statements and reports, which we will present and explain later in the article alongside their relevance in today’s fast-paced, hyper-connected business world.

We offer a 14-day free trial. Benefit from great financial reports today!

What Is A Financial Report?

A financial report (also referred to as financial statement or finance report) is a management tool used to communicate key financial information to both internal and external stakeholders by covering every aspect of financial affairs with the help of specific KPIs.

As you can see in the example above, created with a professional financial business intelligence solution, a modern finance report can have all the relevant information right at your fingertips, offering the ability to visualize as well as analyze key financial data; they assist in uncovering fresh insights, spotting key financial trends, identifying strengths as well as weaknesses, and improving communication throughout the organization. We will explore even more examples of monthly reports later in the article.

We live in a data-driven age, and the ability to use financial insights and metrics to your advantage will set you apart from the pack. The reporting tools to do that exist for that very purpose. To gain a panoramic view of your business’s financial activities, working with a monthly, weekly, and daily financial report template will give you a well-rounded and comprehensive overview of every key area based on your specific aims, goals, and objectives.

Your business needs these reports to help support certain business financial objectives and enable you to provide useful information to investors, decision-makers, and creditors, especially if you work as a financial agency and need to create an interactive client dashboard. But not only, as it can also support your business in determining:

- If your business can effectively generate cash and how that cash is used.

- To reveal specific business transaction details.

- To follow the results of your finances so you can identify potential issues that are impacting your profitability.

- Develop financial ratios that show the position of your business.

- Evaluate if your company can pay off all of your debts.

Daily reports, however, have a limited impact, as most of the financial KPIs that are used need a mid- to long-term monitoring, and do not provide accurate information if analyzed only on a daily basis.

This is why we still mention them and provide examples of what can be tracked and analyzed every day, but for a long-term view, you should take a look at our weekly and monthly reports. Our monthly reports are on top illustrated with beautiful data visualizations that provide a better understanding of the metrics tracked.

Equipped with financial analytics software, you can easily produce these daily, weekly, and monthly reports. They will provide your business with insights it needs to remain profitable, meet objectives, to evaluate your decision-making processes, and keep everyone in the value chain on track.

How To Make A Financial Report?

To create a comprehensive financial statement and/or report, you need to keep these points in mind:

1. Define your mission and audience

No matter if you’re a small business or large enterprise, you need to clearly define your goals and what are you trying to achieve with the report. This can help both internal and external stakeholders who are not familiarized with your company or the financial data. If you’re creating an internal report just for the financial department, it would make sense to include financial jargon and data that, otherwise, would create challenges for external parties to follow.

By defining the mission and audience, you will know how to formulate the information that you need to present, and how complex the jargon will be. Create a draft of the most important statements you want to make and don’t rush with this step. Take your time, the numbers, charts, and presentations come later.

2. Identify your metrics

In this step, you need to identify the key performance indicators that will represent the financial health of your company. Depending on the selected metrics, you will need to present the following:

Balance sheet: This displays a business’s financial status at the end of a certain time period. It offers an overview of a business’s liabilities, assets, and shareholder equity.

Income statement: This indicates the revenue a business earned over a certain period of time and shows a business’s profitability. It includes a net income equal to the revenues and gains minus the expenses and losses.

Cash flow statement: Details a business’s cash flows during certain time periods and indicates if a business made or lost cash during that period of time.

These financial statements will help you get started. Additionally, you might want to consider specific KPIs and their relations. Gross profit margin, operating profit margin, operating expense ratio, etc., all have different applications and usage in a relevant financial data-story. Take your time to identify the ones you want to include in your financial report of a company in order to avoid multiple repeats afterward.

3. Choose the right visualizations

Continuing on our previous point, after specifying the financial statement and metrics you want to add, it’s time to include visuals. This point is important since the average reader will struggle to digest raw data, especially if you work with large volumes of information.

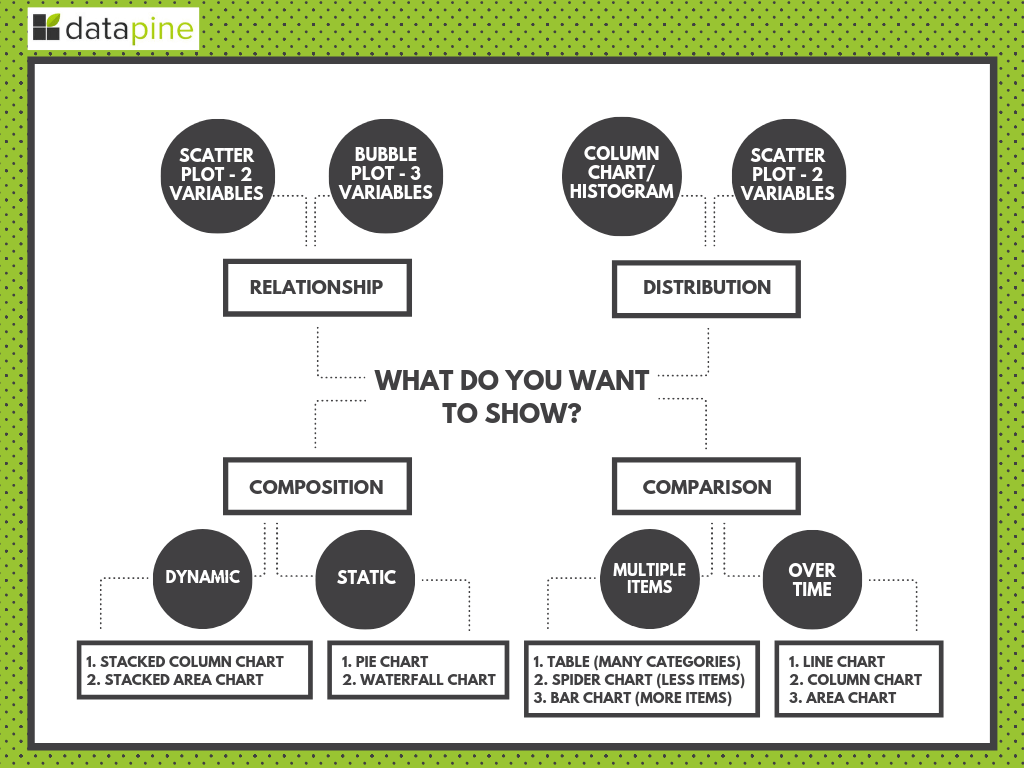

The type of chart is important to consider since the visuals will immediately show the relationship, distribution, composition, or comparison of data, therefore, the type of charts will play a significant role in your reporting practice. Here is a visual overview that can help you in identifying which one to choose:

**click to enlarge**

In the overview, we can see that scatter plots and bubble plots will work best in depicting the relationship of the data while the column chart or histogram in the distribution of data. To learn more about a specific chart and details about each, we suggest you read our guide on the top 15 financial charts.

4. Use modern software & tools

To be able to effectively manage all your finance reports, you will need professional tools. The traditional way of reporting through countless spreadsheets no longer serves its purpose since, with each export, you manage historical data and don’t have access to real-time insights. The power of a modern dashboard builder lays within the opportunity to access insights on-the-go, in real-time, and with refreshing intervals that you can set based on your needs.

Moreover, professional dashboard software comes with built-in templates and interactivity levels that traditional tools cannot recreate or offer in such simplicity but, at the same time, a complexity that will make your reports more informative, digestible, and, ultimately, cost-effective.

To manage financial performance in comparison to a set target, you can also use a modern KPI scorecard. That way, you will not only monitor your performance but see where you stand against your goals and objectives.

5. Automate your financial management report

Automation plays a vital role in today’s creation of company financial reports. With traditional reporting, automation within the application is not quite possible, and in those scenarios professionals usually lose a lot of time since each week, month, quarter, or year, the report needs to be created manually. Automation, on the other hand, enables users to focus on other tasks since the software updates the report automatically and leaves countless hours of free time that can be used for other important tasks. We will see a simple financial report sample created with automation in mind below in our article.

For example, you can schedule your financial statement report on a daily, weekly, monthly, or yearly basis and send it to the selected recipients automatically. Moreover, you can share your dashboard or select certain viewers that have access only to the filters you have assigned. Finally, an embedded option will enable you to customize your dashboards and reports within your own application and white label based on your branding requirements. You can learn more about this point in our article where we explain in detail about the usage and benefits of professional embedded BI tools.

These reports are more digestible when they are generated through online data visualization tools that have numerous interactive dashboard features, to ensure that your business has the right meaningful financial data. Finally, these reports will give your business the ability to:

- Track your revenue, expenses, and profitability.

- Make predictions based on trusted data.

- Plan out your budget more effectively.

- Improve the performance of your processes.

- Create fully customizable reports.

Now that we have detailed a little bit about what’s included in these reports and how to create them, we are going to take a closer look at financial statements examples of daily, weekly, and monthly financial reports and their associated financial KPIs. These financial statements examples will help your organization tick over the right way. Let’s get started.

We offer a 14-day free trial. Benefit from great financial reports today!

What Should Be Included In A Monthly Financial Report – Examples & Templates

Monthly financial reports are a management way of obtaining a concise overview of the previous month’s financial status to have up-to-date reporting of the cash management, profit and loss statements while evaluating future plans and decisions moving forward.

This example of financial report offers a more panoramic view of an organization’s financial affairs, serving up elements of information covered in our daily and weekly explanations. By offering the ability to drill down into metrics over a four-week period, the data here is largely focused on creating bigger, more long-term changes, strategies, and initiatives.

These reports offer detailed visual insights into the following areas:

- Cash management: A comprehensive overview of your organization’s liquidity and existing cash flow situation.

- Profit and loss: A critical glimpse into your company’s income statement and profits in a number of critical areas of the business.

- The bigger picture: A business financial report format offers a full overview of the company’s core financial activities over a monthly period, providing data geared towards developing sustainable strategies and improvements that will foster growth and increased profitability.

Coupled with the insights delivered by daily and weekly reports, monthly reports in the form of online dashboards are pivotal to not only gaining an edge on your competitors but also getting a predictive vision that will ensure you meet – and even exceed – your financial targets indefinitely. As a result, your business efficiency will become flawless, and you’re likely to enjoy healthy growth in your year-on-year profits.

There is a wealth of KPIs to consider when looking at a monthly financial report sample. The best way to explain them in a practical context is by getting visual.

To help you understand how you can benefit from financial visualizations, here are 5 monthly report examples, complete with explanatory insight and a deeper insight into their respective KPIs.

These interactive financial reports examples demonstrate the detail and insight you can gain from your online data analysis if you use it in the right way.

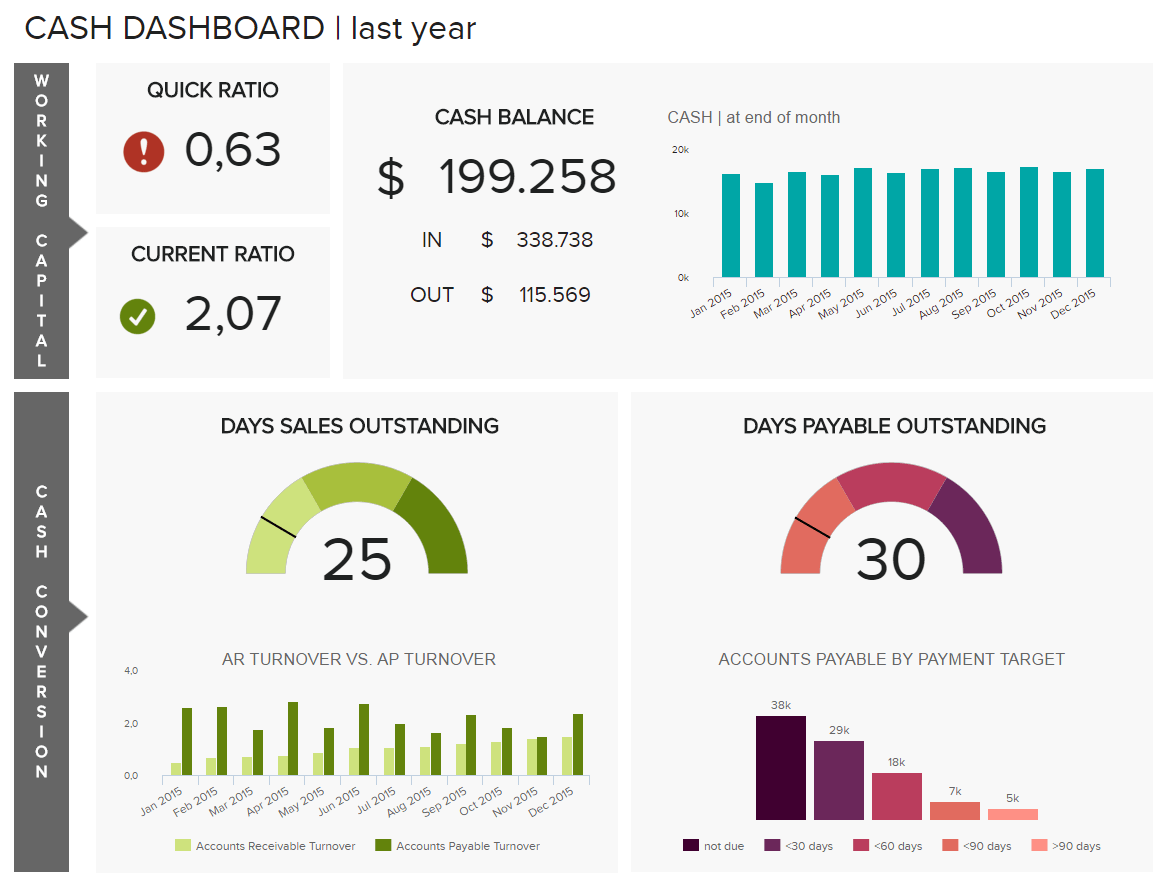

a) Cash Management Financial Report Template And KPIs

Our first example provides you with a quick overview of your liquidity and current cash flow situation. This example of financial report is critical to keeping your finances flowing across the organization.

**click to enlarge**

Current ratio: Core indication of a business’s short term financial health, as well as indicating if you’re promptly collecting Accounts Due.

- This metric is measured by dividing debt and accounts payable by cash inventory and accounts receivables.

Accounts payable turnover ratio: This shows how quickly your business pays off suppliers and other bills. It also shows the number of times your business can pay off average accounts payable balance during a certain time period.

- For example, if your company purchases 10 million of goods in a year, and holds an average account payable of 2 million, the ratio is 5.

- A higher ratio shows suppliers and creditors that your company is on top of paying its bills.

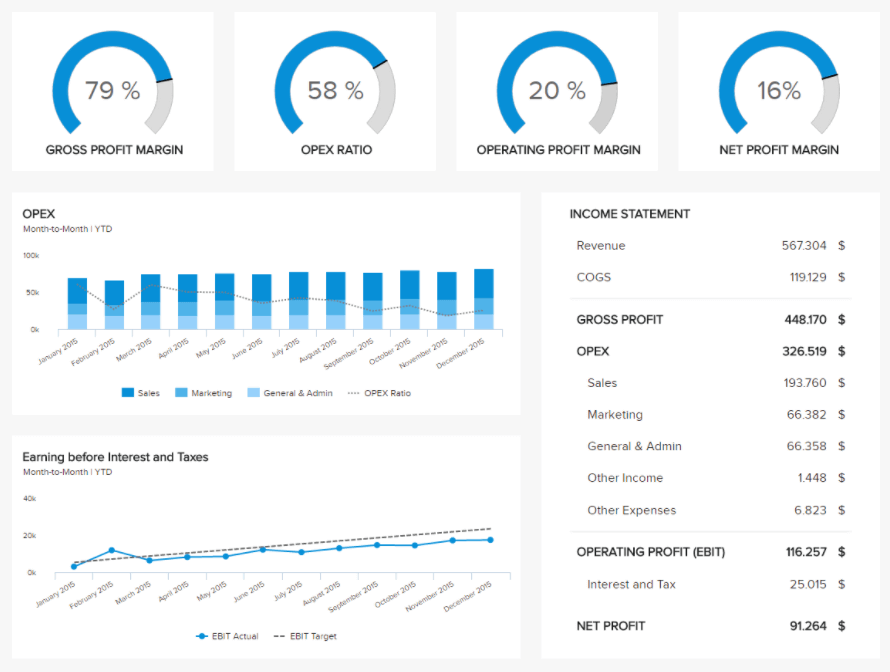

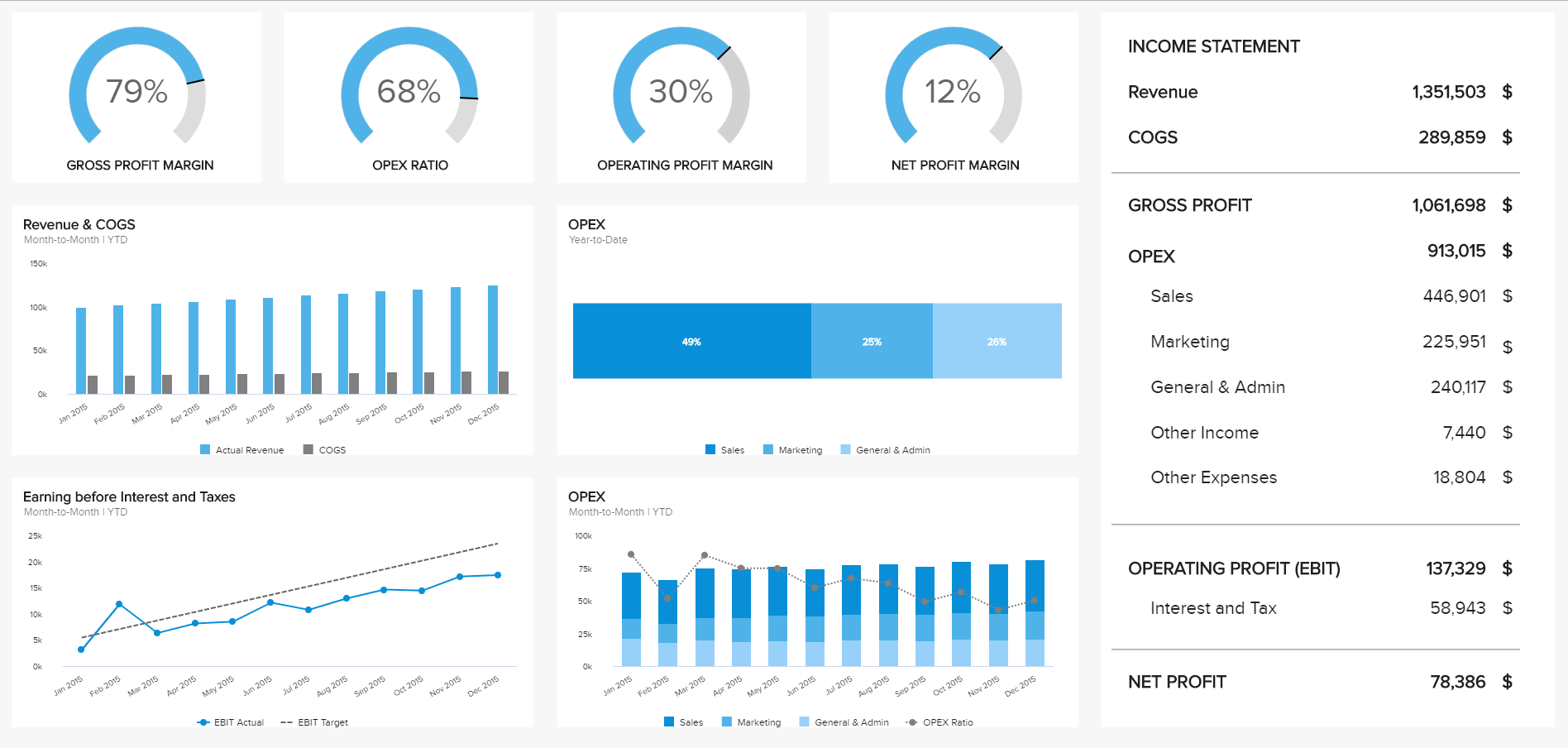

b) Profit And Loss Financial Report Examples And KPIs

Our next monthly report gives a clear overview of the income statement, from the revenue earned to the final net profit, the whole being enhanced by relevant performance ratios.

**click to enlarge**

Operating profit margin: It allows your business to monitor how much profit you are generating for each dollar of revenue. This metric is also referred to as “EBIT”, for “earnings before interest and tax”.

- This metric measures how profitable your business model is and shows what’s leftover from your revenue after paying for operational costs.

- It doesn’t include revenue earned from investments or the effects of taxes.

Operating expense ratio: This monthly financial report example indicates the operational efficiency of your business through the comparison of operating expenses and your total revenue.

- Essentially the lower your operating expenses the more profitable your business.

- These KPIs are particularly helpful to benchmark your company against other businesses.

Net profit margin: Measures your business’s profit minus operating expenses, interest, and taxes divided by total revenue.

- It’s one of the most closely monitored financial KPIs. The higher the net profit margin, the better.

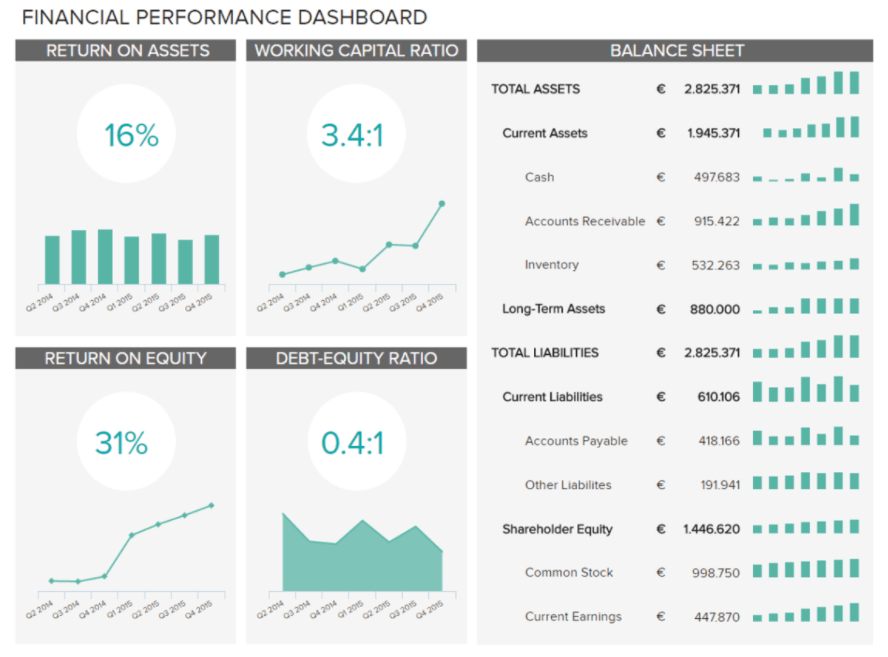

c) Financial Performance Report Template And KPIs

This particular monthly financial report template provides you with an overview of how efficiently you are spending your capital while providing a snapshot of the main metrics on your balance sheet.

**click to enlarge**

Return on assets (ROA): Shows how profitable your businesses are compared to your total assets. Assets include both debt and equity.

- This is a critical metric to any potential investors because it shows them how efficiently management is using assets to generate earnings.

Return on equity (ROE): Calculates the profit your company generates for your shareholders. It is used to compare profitability amongst businesses in the same industry.

- This is measured by dividing your business’s net income by your shareholder’s equity.

We offer a 14-day free trial. Benefit from great financial reports today!

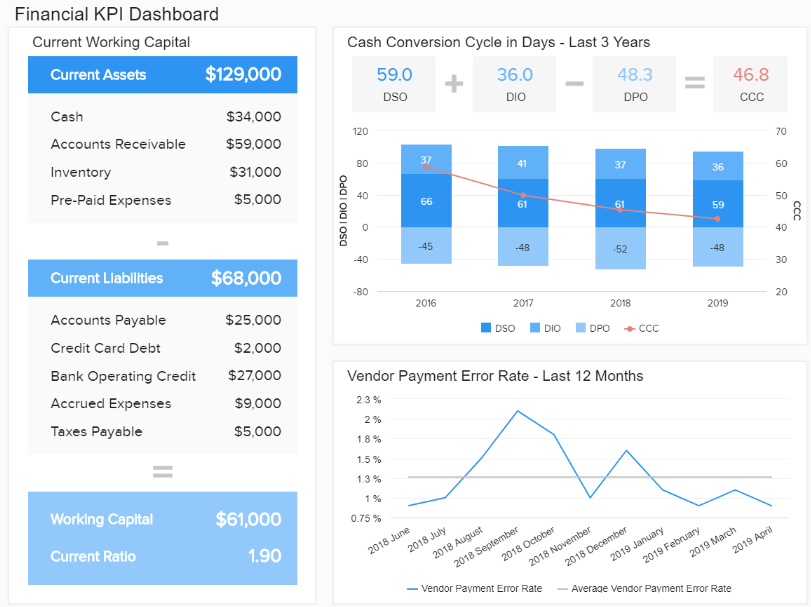

d) Financial KPI Dashboard And KPIs

This financial report sample offers a broad overview of your business’s most critical economic activities, operating with KPIs that are developed specifically to answer vital questions on areas such as liquidity, invoicing, budgeting, and general financial stability. A financial report format that you can apply to almost every business across industries, this incredibly insightful tool is pivotal to maintaining a healthy, continually evolving financial profile. Let’s look at the KPs linked to this most valuable of financial reports examples.

**click to enlarge**

Working capital: A financial key performance indicator focused on financial stability, this metric will help you monitor your performance based on your company’s assets and liabilities.

- In the context of this financial report format, working capital is vital as it will help you accurately gauge your business’s operational efficiency and short-term financial health.

Quick ratio/acid test: A KPI that offers instant insights as well as results, this metric serves up critical information concerning liquidity.

- The quick ratio/acid test report example is worth tracking – by measuring these particular metrics, you’ll be able to understand whether your business is scalable, and if not – which measures you need to take to foster growth.

Cash conversion cycle: Your cash conversion cycle (CCC) is a critical financial metric for any organization as it drills down into key areas of your company’s operational and managerial processes.

- Tracking your CCC with visual BI reporting tools is incredibly useful as it provides a quantifiable means of knowing the length of time it takes for your business to convert its inventory investments, in addition to other resources, into cash flows from sales.

- A steady, consistent CCC is generally a good sign, and if you spot noticeable fluctuations, you should conduct further analysis to identify the root of the issue.

Vendor payment error rate: Every business – including yours – works with third-party vendors or partners, and managing these relationships as efficiently as possible is critical to any organization’s ongoing financial health. That’s where the vendor payment error rate KPI comes in.

- By gaining an insight into potential errors or efficiencies relating to the payment of your vendors, you’ll be able to improve financial flow and efficiency while nurturing your most valuable professional relationships.

- If your vendor error rate is high, you will know that procurement inefficiencies exist, and you’ll be able to take appropriate action to improve your processes and avoid potential disputes.

Budget variance: Budgeting is one of the cornerstones of corporate financial health. This powerful KPI from this most critical financial report sample serves to express the difference between budgeted and genuine figures for a particular accounting category.

- Offering a quick-glance visualization of whether particular budgets are on track in specific areas of the business, this KPI allows you to get a grasp of variances between proposed and actual figures while obtaining the information required to make vital changes in the appropriate areas.

- Keeping your budget expectations and proposals as accurate and realistic as possible is critical to your company’s financial growth, which makes this metric an essential part of any business’s reporting toolkit.

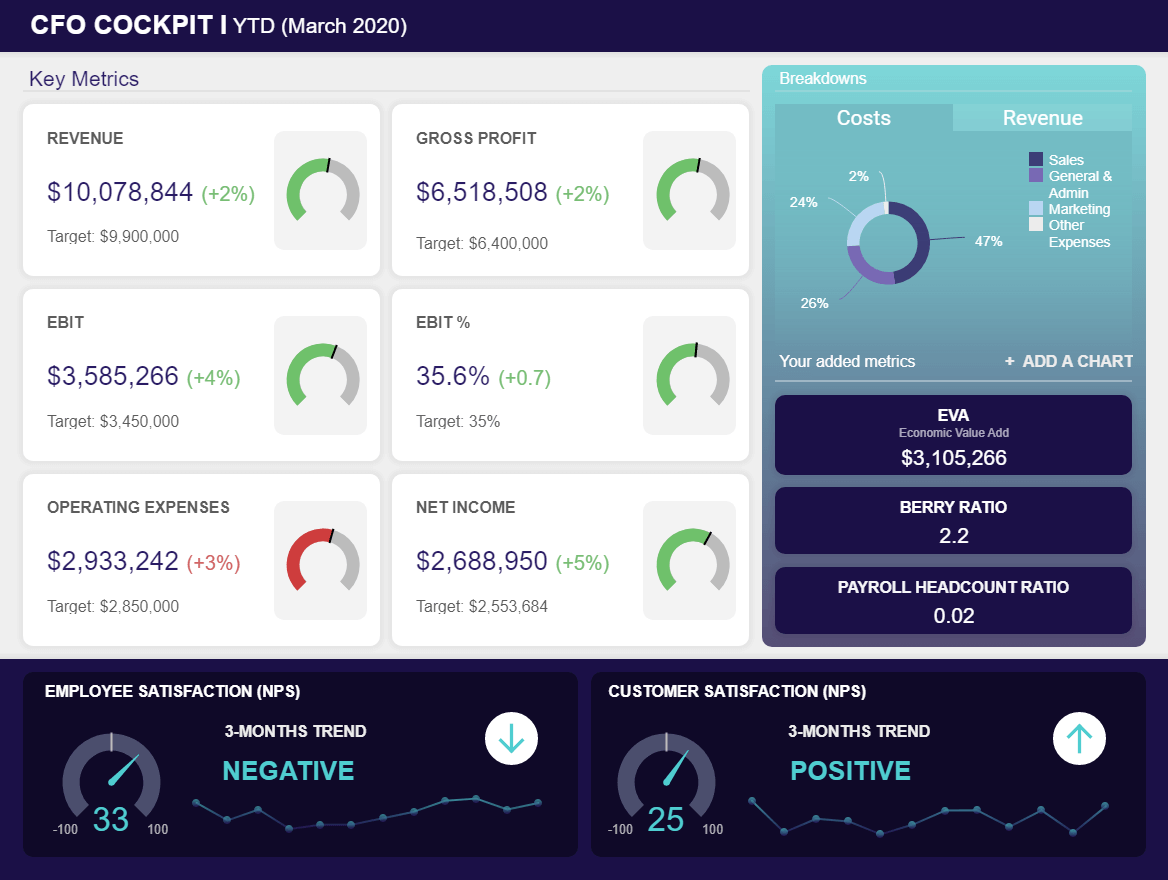

e) Financial Statement Example For CFOs

Finally, we look into a financial performance report focused on data relevant for chief financial officers (CFOs) that need to grasp high-level metrics such as revenue, gross profit, operating expenses, net income, berry ratio, EVA, payroll headcount ratio and, finally, to build a strong team and customer base, satisfaction levels of each. This financial management report example will not only serve as a roadmap for depicting the financial health of a company but also focus on team management and customer satisfaction that are not traditional finance-related metrics, but important in this case for every modern CFO. This example shows the YTD until March but it can also be used as one of our monthly financial statements examples. We will explain the KPIs in more detail below:

**click to enlarge**

Berry ratio: This ratio is defined between the gross profit and operating expenses (costs). This financial indicator is critical when showing if the company is generating a healthy amount of profit or losing money.

- When calculating the berry ratio, usually external income and interest aren’t included, but depreciation and amortization could be, depending on the particularities of your financial strategy.

- An indicator over 1 means that the company is making a profit above all expenses while a coefficient below 1 will indicate that the company is losing money.

Economic value added (EVA): Referred to as the economic profit of a company, EVA is a critical element to include in any finance report template as it will show the surplus profit over the WACC (weighted average cost of capital) demanded by the capital market.

- By gaining insights into the potential surplus and how profitable a company’s projects are, the management performance can be reflected better. Moreover, it will reflect the idea that the business is profitable only when it starts to create wealth for its shareholders.

- Succinctly speaking, the financial statement report should include EVA as it will show how much and from where a company is creating wealth.

Cost breakdown: This particular metric is extremely important in any finance department since costs are one of the financial pillars of an organization, no matter how large or small. Every business needs to know where the costs are coming from in order to reduce them and, consequently, positively affect financial performance.

- If you see that most costs come from administrational activities, you should consider automating tasks as much as possible. By utilizing self service analytics tools, each professional in your team will be equipped to explore and generate insights on their own, without burdening other departments and saving countless working hours.

- Generally, costs should not be looked upon purely on the base of black and white. If sales and marketing cause cost increment, maybe they also deliver high volumes of revenue so the balance is healthy, and not negative.

Satisfaction levels: C-level managers need to prepare financial reports with the satisfaction levels in mind. These indicators are not purely financial, but they do influence the financial health and can cause potential bottlenecks.

- If the financial team has a lower satisfaction level, you need to react fast in order to avoid potential talent loss that can cause the company serious money. Keeping the team satisfied by conducting regular feedback talks, offering career progression and competitive salaries, for example, can only affect the business in positive ways since the motivation will rise as well as the quality of the working environment. In this case, you can also connect an HR dashboard and follow the team’s performance and satisfaction levels in more detail.

- If customers are unsatisfied, it can also cause damages from outside of your team that can, consequently, influence the financial performance as well.

The above example of financial statement is not only focused on pure numbers, as you can see but also on the human aspect of team and customer management that every modern CFO needs to take into account in order to benefit financial strategies and deliver economic growth.

Weekly Financial Report Examples And KPIs

A weekly financial report serves to help your business monitor all your short-term financial activities in weekly increments. It should be created and reviewed each week and provides a comprehensive look at the short-term performance of your business.

Now we will take a look at some financial statements examples to get a clearer picture of what can be tracked in weekly intervals.

a) Operating Cash Receipts, Disbursements, Balance

Part of a business’s budgeting process may include cash receipts and disbursements, which uses actual data for cash collection to design a budget, or create income statements, for example. A sample financial report on a weekly basis can help companies gain insights from accurate reporting based on using cash receipts and disbursements. Metrics and KPIs can include:

Cash flow report: indicates the changes in cash versus its fixed counterparts, such as exactly where cash is used or generated during the week.

- Operating activities: measures a business’s operating cash movements, whereby the net sum operating cash flow is generated.

- Financing activities: tracks cash level changes from payments of interest and dividends, or internal stock purchases.

- Investing activities: tracks cash changes derived from the sale or purchase of long term investments, like property, for example.

Operating activities: indicated any activities within a business that affect cash flows, such as total sales of products within a weekly period, employee payments, or supplier payments.

- Direct method: This metric obtains data from cash receipts and cash disbursements related to operating activities. The sum of the two values = the operating cash flow (OCF).

- Indirect method: This metric uses the net income and adjusts items that were used to calculate the net income without impacting cash flow, therefore converting it to OCF.

Gross profit margin: This enables your business to measure and track the total revenue minus the cost of goods sold, divided by your total sales revenue.

- This KPI is a crucial measurement of production efficiency within your organization. Costs may include the price of labor and materials but exclude distribution and rent expenses.

- For example, if your gross profit margin was 30% last year, you would keep 30 cents out of every dollar earned and apply it towards administration, marketing, and other expenses. On a weekly basis, it makes sense to track this KPI in order to keep an eye on the development of your revenue, especially if you run short promotions to increase the number of purchases. Here is a visual example:

b) Any Generated Current Receivables

Weekly financial reports can help businesses stay on top of invoicing, billing procedures, cash basis of accounting, accounting records, and ensure that they don’t fall behind on being paid for services and goods that are owed to you from customers or suppliers. Weekly report metrics and KPIs include:

- Days sales outstanding (DSO): This measures how fast your business collects money that you’re owed following a completed sale.

DSO = (Accounts receivable / total credit sales) x number of days in period. - DSO vs. best possible DSO: Aligning these two numbers indicates the collection of debts in a timely fashion.

Best possible days sales outstanding = (Current receivables x number of days in a week) / weekly credit sales. - Average days delinquent: Indicates how efficient your business processes are in your ability to collect receivables on time.

ADD= Days sales outstanding – Best possible days sales outstanding

Top Daily Financial Reporting Examples And KPIs

A daily financial report is a method to track the previous day’s activities that have an impact on your financial status but are not necessarily a strict financial metric. It can keep you apprised of all the requisite data management used to track and measure potential errors, internal production, revenue loss, and receivables’ status.

As we mentioned above, these reports provide a limited vision, but you can use the examples beneath to see how some daily actions on problematic factors that can impact your final results.

a) Tracking Potential Staff Errors

Maintaining an efficient, productive work environment, and ensuring that you can identify any employee discrepancies or issues is critical to being proactive about business growth. Monitoring employees working hours and productivity levels can help you detect potential staff errors quickly, control these errors, and avoid negative impacts on your financial results at the end of the day, and ultimately, the month.

Real-time management live dashboards offer clear visuals regarding employee management processes with the following metrics and KPIs:

Organizational performance: These are key metrics for tracking and evaluating some factors impacting your performance.

- Employee overtime: overtime per employee = total overtime hours / FTE

- Absenteeism: Number of employees absent today

Work quality: These metrics help companies determine the quality level of their employees’ work performance.

- Amount of errors

- Product defects

Work quantity: These metrics indicate the employee performance related to quantity, such as sales figures, or the number of codes a programmer can create in a given amount of time. Quantity does not, of course, mean quality, but on monitored daily, it can reveal bottlenecks or under-production problems.

- Sales numbers: the number of client contacts, the number of calls an employee makes, the amount of active sales leads.

- Units produced: lines produced during coding, number of keys a nurse receptionist can hit per minute, etc.

- Customer handling time: how many customer calls are answered during a specific time period, for example.

b) Measure Revenue Loss & Receivables

By tracking staff errors, you can track the money it costs your company (having a problem in production, finding the problem and fixing it), which will inevitably end up in your financial statements, as the money you lost. Tracking revenue loss can be especially beneficial for those companies with customer accounts or recurring revenue. A daily report helps businesses quickly monitor revenue-related factors, so they can increase their revenue. Revenue loss can also originate from one-time purchases, customers who move to your competitor, or customers who move out of the area. Metrics used to measure these factors can include:

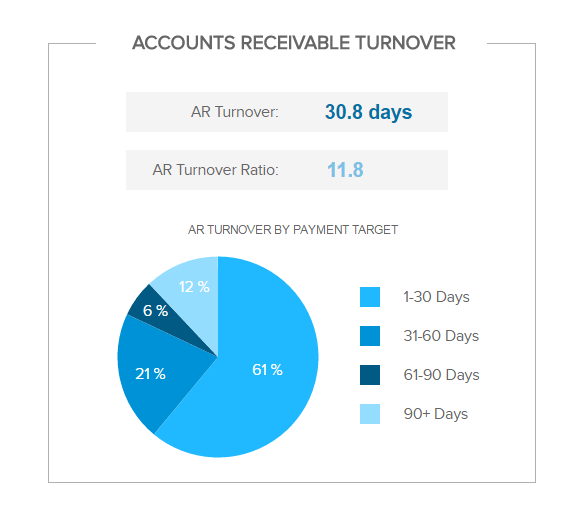

Accounts receivable turnover ratio: Measures the number of times that your business is able to collect average accounts receivable, and indicates your effectiveness on extending credits. Here is a visual example:

- A low accounts receivable turnover ratio basically indicates that you might need to revise your business’s credit policies to collect payments more quickly.

Additional metrics you can monitor on a shorter time frame, such as daily, are as follows:

- Number of daily transactions

- Average gross margin

- The average cost per order

You can also be more specific about your revenue loss: categorizing where you lost what is a good practice to identify which parts of your business management reporting practices have an important room for improvement. Tracking metrics like the top 10 products generating the most revenue, or on the contrary, the top 10 products generating the worse revenue will tell you a story about what needs more attention.

The revenue loss can also come from discounts or sales, for example. Monitoring on a daily basis which promotions are getting “too” popular can help you stop it before it generates more revenue loss than revenue growth that was supposed to create.

We offer a 14-day free trial. Benefit from great financial reports today!

“I believe that through knowledge and discipline, financial peace is possible for all of us” – Dave Ramsey, radio host and financial expert

A daily, weekly, and monthly financial report help communicate the ongoing narrative of your company’s economic processes, strategies, initiatives, and progress. As you can see, these forms of an analytical report in the finance industry is an undeniably potent tool for ensuring your company’s internal as well as external financial activities are fluent, buoyant, and ever-evolving.

Comprehensive Reports For The Complete Financial Story Of Your Business

We’ve explained how to write a financial report, examined the dynamics of a monthly, daily, and weekly financial report template, explored financial reports samples relating to specific areas of the business, and explored related KPIs in detail. Now, it’s time to look at the concept as a whole.

Financial reporting practices help your business obtain a clear, comprehensive overview of where your company is at, and where you should plan on going. When augmented with crisp, easy-to-read visualizations in the form of financial dashboards, your business can quickly comprehend and accurately measure critical components of your financial status over specified time periods.

A sample financial statement like we presented above can also help you answer critical questions, such as what can your business do with an extra $500k in cash? Will you be able to borrow less money, invest in new technology, or hire trained personnel to improve your sales?

Using datapine’s seamless software, your business will be able to see the full financial story of your company come to life, and have a better grasp of your future financial path.

When it comes to your business’s finances, shooting in the dark or using antiquated methods of analysis or measurement will not only stunt your organizational growth but could lead to mistakes, errors, or inefficiencies that will prove detrimental to the health of your business. Data-driven, dashboard reporting is the way forward, and if you embrace its power today, you’ll reap great rewards tomorrow and long into the future.

Do you want to improve your business’s financial health today? Try our 14-day trial completely free!

The post 9 Examples Of Financial Reports You Can Use For Daily, Weekly, And Monthly Reports appeared first on BI Blog | Data Visualization & Analytics Blog | datapine.